Remitly: Winning the First Send, Owning the Rest

A category winner trading at <8x ‘27e free cash flow

Remittances are an annuity business disguised as a payment product.

Once you earn a customer’s trust, they send again and again with little interest in switching. That loyalty results in a high retention customer and a valuable business.

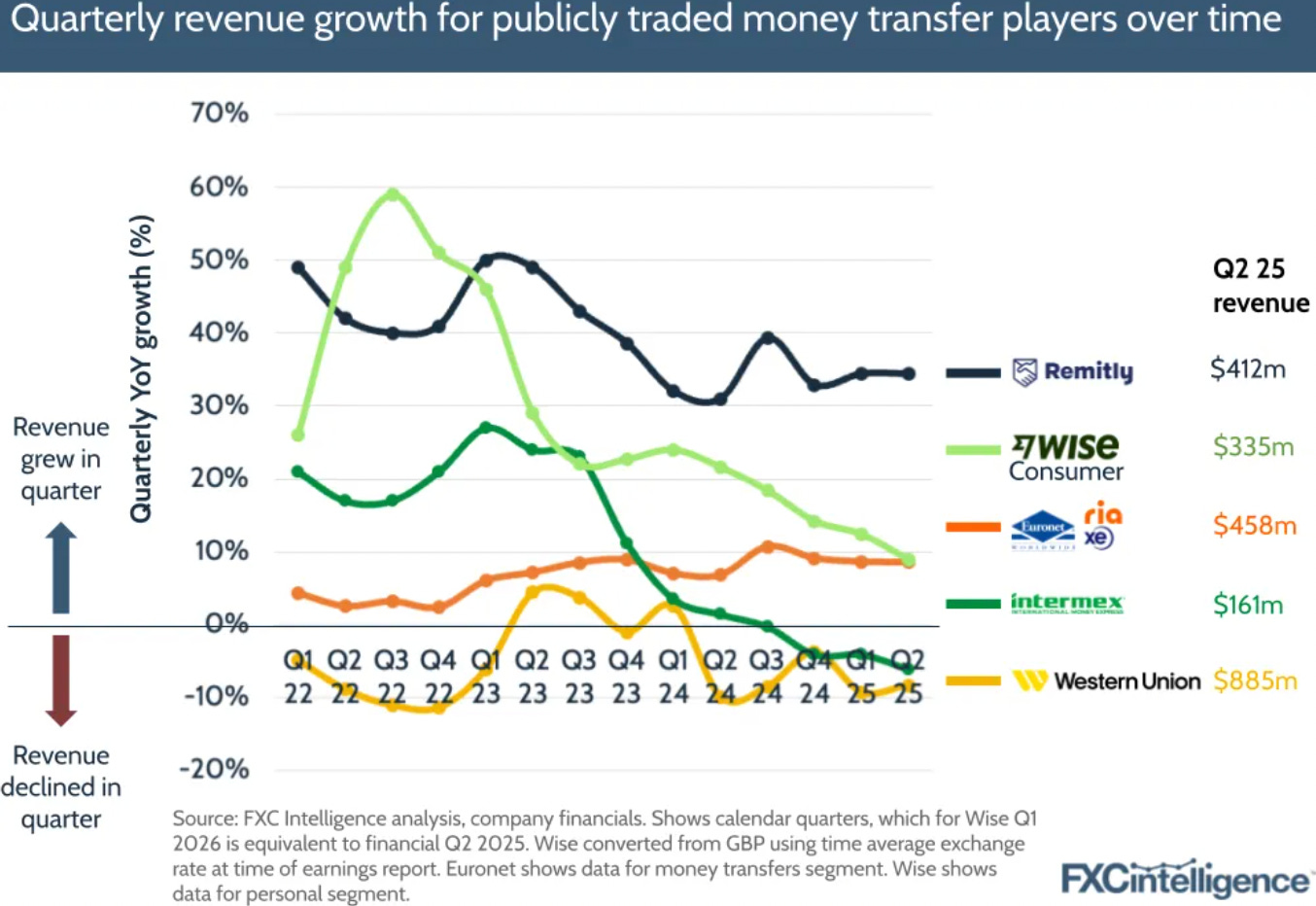

Remitly has built the dominant digital remittance franchise, has mastered customer acquisition at scale, and is taking material market share from cash agent networks. Remitly is growing revenue 34% as of Q2 ’25 and is on a path to 25+% free cash flow margins.

Yet the market values Remitly at less than 8x ‘27e unlevered free cash flow.

Investors are worried about two issues: stablecoins and immigration regulation. I think neither poses a terminal threat to Remitly. Stablecoin infrastructure is gaining adoption, but stablecoin wallets will likely take decades to make a dent in consumer payment behavior. My read is that the stablecoin end state will be a world in which Remitly can still run a major remittance business. Immigration regulation is even less of a concern, given that the One Big Beautiful Bill just penalized cash transfers while favoring digital remittances.

Remitly has the potential to grow to multiples of its current size and generate billions in free cash flow. I expect the company to benefit from increasing consumer awareness as they gain scale, maintain a decisive marketing advantage, and continue to perfect their digital remittance product. What matters is customer trust, the smoothest customer product experience, a fair price, and disciplined return on marketing spend.

Remitly is cheap, growing fast, and durable. For investors, this setup offers the chance to buy a category winner at a bargain basement price.

—

1. Why Xoom should have won digital remittances (a brief history)

2. Remitly is winning the scaled marketing and retention game

3. Stablecoins: settlement threat, not consumer threat

4. Trump’s policies favor the cash to digital remittance transition

5. Remitly is trading at <8x '27e unlevered free cash flow with 34% YTD revenue growth

—

1. Why Xoom should have won digital remittances (a brief history)

Every remittance has three steps:

1. Pay-in from the sending customer

Cash

ACH transfer

Credit card

Debit card

Stablecoin

(Money already in sending wallet)

2. Money transfer from the sending to the receiving country banks

Correspondent banks

National payment systems

Stablecoin

3. Pay-out to the receiving customer

Cash pickup / delivery

Digital account

Stablecoin

(Money staying in wallet)

Remittances are driven by people leaving their country for higher paying jobs and sending excess savings back to family and friends. Developed economies face labor shortages for high-skill industries (e.g. tech workers) and service sector work (due to aging and the rise of the dual-income family). These labor shortages are significant and worsening, so migrant workers and remittances will be a mainstay of our economy for the foreseeable future.

The remittance industry began in the United States when Western Union launched commercial money transfers in the 1870s. Their business model evolved from company-owned counters to an outsourced agent network. A “send agent” and a “receive agent” handle the customer cash pay-in and pay-out in return for a 40%-60% total commission. Western Union brands the locations, coordinates the network, and maintains regulatory compliance. For many years, Western Union agent locations were the most convenient place to send an international money transfer.

By 2006, Western Union refocused their business solely on money transfers. MoneyGram, a descendant of Travelers Express, emerged as the chief rival. Today these retail models are low-single-digit revenue growers with 20+% Non-GAAP EBIT margins. Take rate per retail transfer runs in the range of 6%-10% of send volume.

Only two factors drive consumers to adopt a new payment method: it’s more convenient or it’s cheaper. The past 20 years have witnessed a shift from in-person cash transfers to more convenient digital remittances.

Founded in 2001, Xoom invented the digital approach that is dominating today.

Here is the playbook created by Xoom and later perfected by Remitly:

Market to diaspora media channels in developed economies.

Incentivize the first send with a significant FX discount.

Pay-in by ACH transfer (and later by debit card).

Create a one-click repeat remittance send on a website/app.

Tune the transaction rejection rate to keep honest users out of compliance purgatory.

Maintain KYC/AML compliance standards.

Charge a 2%-3% take rate vs. physical retail players at 6%-10%, which Xoom/Remitly can afford because their product is higher retention + they don’t have to pay agent commissions.

Most investors imagine remittance customers shop around like air travelers on Google Flights, comparing every price before booking. They do not.

The reality may surprise you:

Most consumers effectively do not price compare after sending their first digital remittance.

So the whole game is to incentivize the first send, charge fair prices, and maintain high retention with a good UI + a tuned transaction rejection rate.

Why don’t consumers price compare?

First, the search costs are high to learn about various remittance methods when you already have an app on your phone that does what you need.

Second, it’s a hassle to re-enter banking information into multiple apps when you’ve already got one up and working. Remember that you need to sync the bank information for both senders and receivers for each new app you try.

Third, transaction rejection rates are relatively high. Consumers often prefer the certainty of a remittance process that works rather than worry about KYC/AML or canceled transactions.

That transaction rejection rate is critical. Remittances are extremely high-risk for banks: if the funds are misdirected, the cash is gone. However, put up too many security roadblocks, and honest customers go elsewhere. Thus, remittance companies face a tradeoff between security and user convenience. Fintechs who don’t focus on remittances tend to lose because their compliance departments bloat the user experience.

Xoom cracked the formula and went public in 2013. Their digital remittance product looked poised to dominate cash competitors like Western Union and MoneyGram. But Xoom squandered what should have been an insurmountable lead with a critical product choice.

Xoom chose to protect their gross margin by favoring ACH pay-in over debit pay-in. ACH transfers are cheaper for the company and slower for the customer. Remitly favored debit. Debit pay-in is more expensive for the company and nearly instant for the customer. Saving the customer minutes beats saving the company basis points. So Xoom began losing digital share to players like Remitly.

PayPal then acquired Xoom in 2015. PayPal cut Xoom’s marketing budget to maximize current EBIT margins and tightened compliance requirements, creating friction in Xoom’s customer experience.

A wide lane opened, and Remitly took it.

2. Remitly is winning the scaled marketing and retention game

Remitly wins the lion’s share of new remittance volume in developed markets by marketing efficiently at scale.

I estimate there will be ~$1 billion in 2025 remittance ad spend, of which Remitly will spend ~$400m, Western Union ~$200m, Wise ~$100m, and the remainder among smaller players.

The unit economics that enable Remitly’s massive marketing spend are as follows:

A typical customer sends ~16 remittances per year.

Pricing averages ~2.25% blended take rate on 0.75% transaction COGS.

Remitly targets a <12 month gross profit payback on customer acquisition cost (CAC), i.e. Remitly breaks even on CAC after 16 or fewer sends.

They see a return of 5x gross profit lifetime value to customer acquisition cost (5x LTV/CAC). That means the average Remitly customer does 90 sends or 1.3 sends per month for 5 years.

From the app data, I estimate that Remitly retains 85%-90% of send volume after the cohorts stabilize in the first year.

This arithmetic allows Remitly to spend as much as they can on marketing so long as they maintain the <12 month CAC payback and 5x gross profit LTV/CAC.

As a result, Remitly is growing much faster than competing remittance vendors at scale.

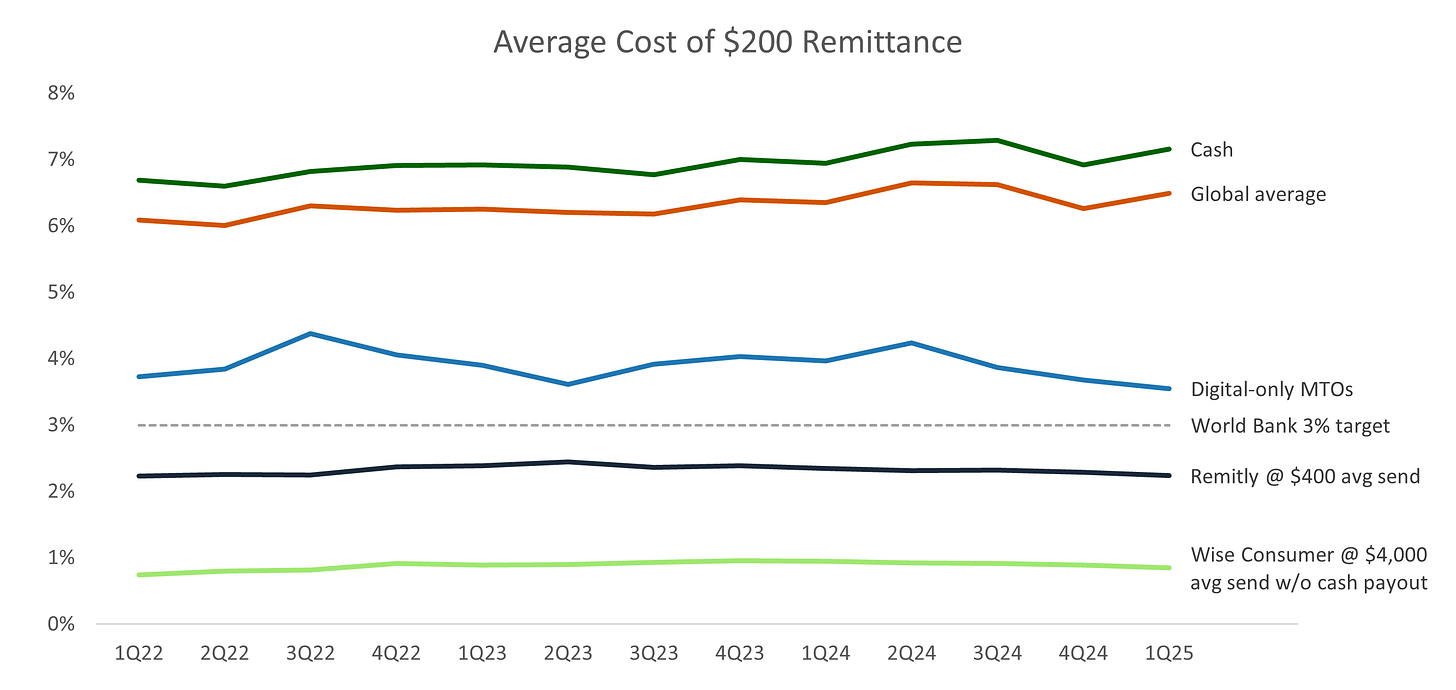

Part of Remitly’s success is due to low pricing. As the World Bank’s take rate comparison shows, Remitly priced below virtually all competitors except Wise (which serves a different customer segment with no cash payout option):

The competitive landscape breaks down into three sets:

General fintech/banks (e.g. PayPal, neobanks, traditional banks)

Physical remittance players (e.g. Western Union, Intermex, MoneyGram, Ria)

Digital remittance players (e.g. Remitly, Wise, Ria, Xe, Xoom, Felix Pago, Taptap Send)

General fintech/banks tend to view remittances as a sideshow. They have more expensive take rates, fewer payout options, and high transaction rejection rates. The user’s remittance action is often buried several clicks deep in an app that was built for something else. A handful of neobanks in Europe and Latin America subsidize transfers in a few corridors, but the clunky user experience keeps them from threatening remittance players.

Digital makes up approximately 29% of global remittances and is rapidly taking share from physical agents.

Physical networks face a severe channel conflict in this transition to digital. Retail agents feed the legacy business. Most agents aren’t exclusive, so an agent that takes one brand’s cash transfer today might steer the customer to a different brand tomorrow. That makes it challenging for Western Union and MoneyGram to push customers toward digital channels. According to SensorTower data as of July ‘25, Western Union and MoneyGram app activity is flat to down YoY.

Western Union is the leading retail network player. Instead of focusing on digital, Western Union just acquired Intermex for 4x-5x post-synergy EBITDA to “expand and stabilize Western Union’s U.S. retail footprint.” I see WU as a play to maximize cash generation from that retail network, not a digital threat.

And then there are the digital specialists. Among these, Remitly has the largest marketing engine and the broadest reach. Furthermore, SensorTower app data suggests that Remitly is higher retention than other competitors.

Some worry that Remitly will hit a wall on marketing spend. But if anything Remitly is seeing increasing returns to scale. They tell investors that they target a <12 month CAC gross profit payback, but I think their marketing payback was closer to 9 months in 2024. That suggests one of a few good things is happening: (1) rising consumer awareness is fueling organic word-of-mouth, (2) new cohorts are ramping faster than earlier ones, and/or (3) their team of ex-Capital One / ex-Amazon types have unlocked a fresh scaled marketing channel. In any case, saturating diaspora media with ads for the highest retention product is working.

Wise is sometimes thought of as a competitor, but I think they serve a different customer. Wise focuses on high-volume low-margin transfers between bank accounts. They do not support cash payouts, and they do not support as many remittance corridors as Remitly. There is so much ground to cover that I don’t see them running into each other much in the next five years.

All in all, the math favors Remitly. They should generate north of 30% EBITDA margins and convert that to 25+% FCF margins. As a comp, physical remittance players are printing 20+% margins while supporting thousands of storefronts, and Remitly bears none of those costs.

In September ‘25, Remitly will launch new features to drive more send volume: Flex (send now pay later), One ($4.99/month loyalty subscription), and Business (micro SMB features, likely targeting small Payoneer SMB customers). All of these look likely to attract new customers and improve overall retention.

If this were the whole story, then Remitly’s stock would trade at a significant valuation premium.

But two concerns loom in investors’ minds: stablecoins and regulatory risk.

I’ll address those each in turn.

3. Stablecoins: settlement threat, not consumer threat

Consumer behavior with money is slower to change than most people think.

Stablecoins are essentially blockchain-based debit accounts with customers’ savings invested in fiat cash and treasuries. Currently, 98% of stablecoins are pegged to the US dollar, and >80% of transactions take place outside of the US.

Stablecoin consumer wallets sound revolutionary: instant settlement, no correspondent banks, and near-zero fees. But adoption is tiny today, and history suggests that consumer payment shifts take decades.

The core distinction is this: stablecoins have a near-term role as settlement infrastructure but not yet as a consumer product.

For banks, the case to switch from slow sequential correspondent bank settlements to instant synchronized stablecoin settlements is clear, once liquidity is sufficient.

But for digital remittance consumers, there is little incentive to move to stablecoin wallets. A digital remittance customer already gets funds quickly, at a price she accepts, from a brand she trusts.

There are fewer than 5 million consumer stablecoin wallets today. Using credit cards as an analogy, it took thirty years after the BankAmericard launched in 1958 to reach a point where 50% of US households owned a credit card.

The real risk to Remitly would come if both senders and receivers decide to keep money entirely in stablecoin wallets. No pay-in, no pay-out, no FX spreads, no off-ramps to fiat. This would disrupt the entire payments ecosystem as it operates today.

I see two entrenched incumbents who will fight to maintain some version of the current payment infrastructure: credit card issuing banks and countries with capital controls. The first shots were just fired as JPMorgan Chase raised API access fees to disincentivize stablecoin wallet funding. These are fights that will play out over decades, not quarters.

There will be a place for remittances so long as we have migration and wealth inequality across countries. Remitly should be able to adapt to stablecoins in ways that generate significant free cash flow. In particular, I think remittance apps should be able to charge an on-chain FX spread between fiat currencies.

So I don’t see stablecoin wallets as a threat to Remitly’s model.

1. Stablecoins are a settlement infrastructure upgrade.

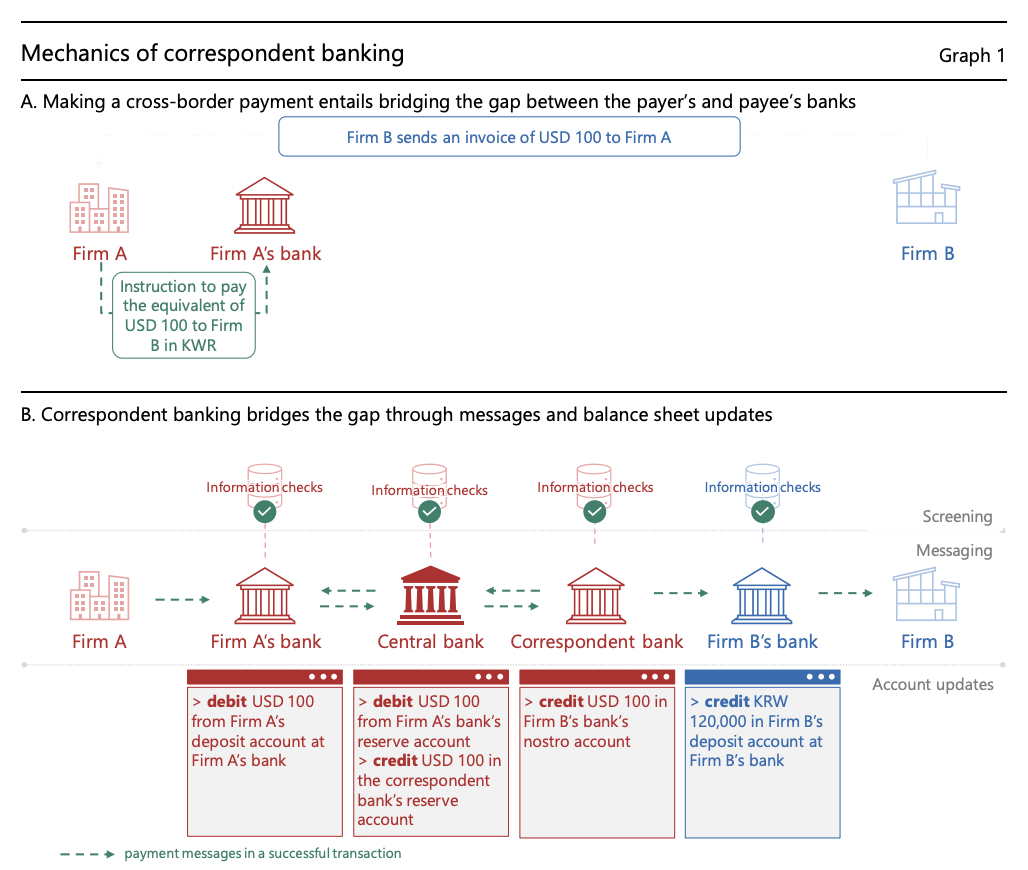

Synchronized stablecoin settlement should replace sequential correspondent banking settlement on the backend.

In the correspondent banking process, cross-border transfers run through sequentially settled transactions. The money hops from the sender’s bank to a correspondent bank, maybe to another intermediary, then finally to the receiver’s bank. Each stop means delays, reconciliations, and added costs. It’s like sending a package that has to pass through three or four warehouses before it gets delivered.

Tokenized transfers (read: stablecoins) jointly settle everything at once on a unified ledger: debiting the payer’s account + crediting the receiver’s account + updating settlements on the central bank balance sheet. That eliminates the creation of new credit exposures among correspondent banks and can shorten a multi-day process into minutes. In the package analogy, it feels like Amazon Prime.

So why haven’t banks already moved en masse?

Liquidity.

Anecdotally, the largest liquidity provider in the USD-INR corridor could handle <3% of Remitly’s volume today. And Remitly is just one player.

Until FX liquidity deepens, stablecoins will remain a promising but niche settlement tool. As FX liquidity improves on-chain over the coming years, we should expect widespread stablecoin adoption for settlements.

2. Remitly is cheaper than stablecoin-backed remittance apps today.

Remittance customers prize two things: convenience and cost.

Digital remittances win because they are much more convenient than in-person remittances (smartphone app vs. in-person) and much cheaper (2%-3% digital vs. 6%-10% retail).

Remitly already settles 93% of transfers within an hour. Its average take rate of ~2.25% with transaction costs near 0.75% of volume makes it cheaper than nearly all competitors, including the stablecoin newcomers.

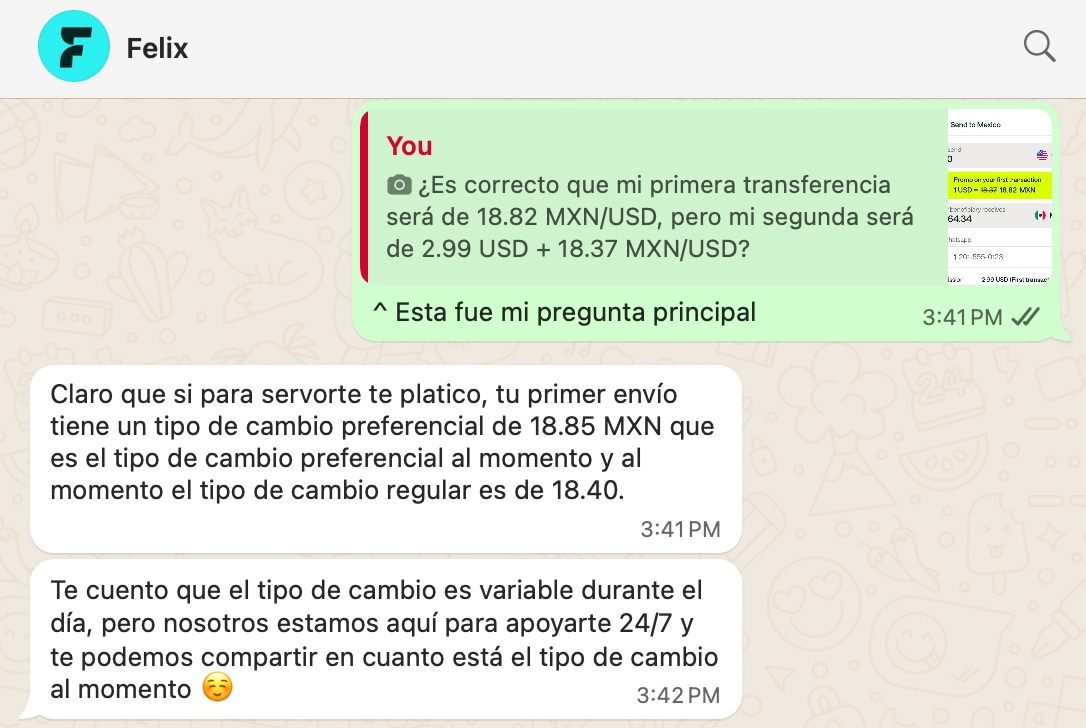

Take Felix Pago, the fastest growing stablecoin-backend remittance startup. Felix is a WhatsApp-based remittance product targeting US-Latin America senders. They use Bitso for USDC on/off ramp and Zero Hashfor compliance.

Felix charges $2.99 + a 1.5% FX markup, or a 2.5% take rate on a $300 transfer. That is essentially identical to Remitly. Felix’s transaction COGS is roughly 0.60% according to partners. The USDC backend provides a minor cost advantage, but stablecoins don’t eliminate any costs for the debit card pay-in or the receiving customer pay-out.

Don’t just take my word for it. Send Felix a WhatsApp message yourself, and ask for their pricing on the second send.

In my example below, the midmarket USD/MXN FX rate was 18.68. The FX rate for the second send is 18.40, meaning that Felix is charging a 1.5% FX profit spread in addition to their $2.99 flat fee.

Felix’s real innovation wasn’t stablecoins. It was using WhatsApp for distribution. Felix killed the app UX and moved to a chat interface. Remitly has already deployed a similar WhatsApp agent and could potentially extend it to other communication apps like Line and Kakao as well as LLM apps like ChatGPT.

Thus, today’s stablecoin remittance apps are not meaningfully cheaper, and they offer no compelling consumer advantage that Remitly cannot copy.

3. The long-run wallet-only risk

The more serious question lies further out. What happens if both senders and receivers live entirely inside stablecoin wallets?

In that world, there is no pay-in, no pay-out, no FX spread, no interchange. Transfer costs could fall to 15 basis points. Customer acquisition might also disappear if consumers are already onboarded into a wallet ecosystem.

The largest economic casualty of account-to-account stablecoin wallet payments wouldn’t be remittance apps. It would be credit card issuers and the existing banking ecosystem.

Let’s pause and consider how early stablecoin wallet adoption is today.

There are 45 million monthly active stablecoin accounts as of July ‘25. Most crypto analysts estimate >90% of those accounts are for trading, leaving only ~4.5 million consumer and merchant stablecoin accounts globally.

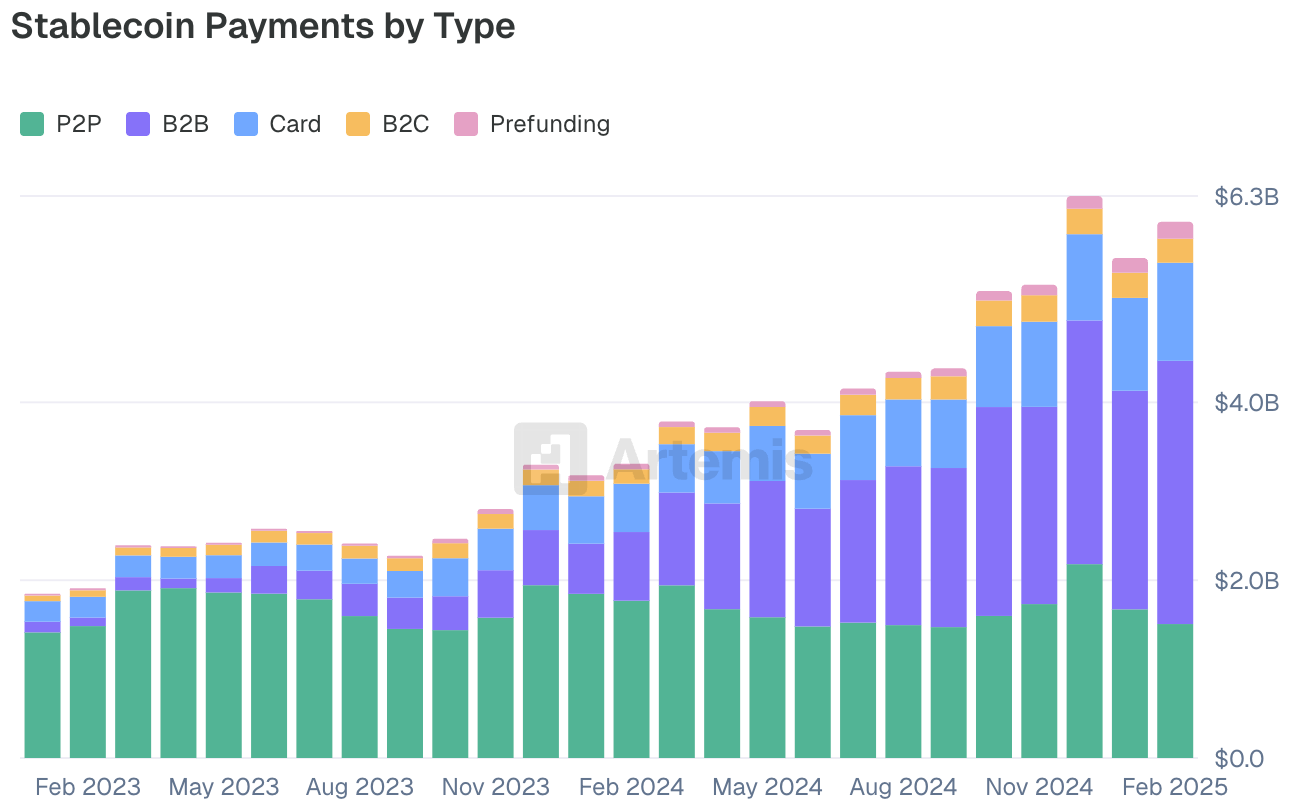

Peer-to-peer stablecoin payment volume is only about $18b annualized, a rounding error compared to global volumes. What’s more, the dramatic growth in stablecoin payment volumes has been driven by B2B and card, not by peer-to-peer (green bars in the chart below).

Two very strong players will fight the rise of consumer stablecoin wallets: credit card issuing banks and countries with capital controls.

-First, the credit card issuing banks aren’t going to sit idle as fintechs siphon their credit card profit streams.

In July 2025, JPMorgan Chase issued significant fee increases on fintech account aggregators and crypto players for API access to customer data. PNC may follow soon. Fintechs rely on this bank customer data to speed up account verification, KYC/AML, and credit checks. To quote an anonymous fintech exec: “JPMorgan’s plans to charge fees would make it economically impossible for many consumers to use stablecoins and crypto.”

Banks may claim this is about stablecoin wallets breaking KYC/AML rules (which is definitely happening) and about consumer privacy (questionable), but that’s not the real motivation.

This is a fight over network access.

Think about how Facebook bootstrapped based on college social directories, Instagram on Twitter, Airbnb on Craigslist, Snapchat on iPhone contacts. Guess which side of this analogy the banks do not want to end up on.

Fintechs may argue that they could replace our payment infrastructure with better and cheaper products, if only they had network access for a fair price. Understandably, the banks disagree on what a “fair price” is for killing the credit card profit stream.

If major banks like Chase and PNC make it cost prohibitive for customers to transfer money into stablecoin wallets, then stablecoin consumer adoption may be smothered before it can achieve escape velocity.

Even if stablecoin wallets do begin to take off, expect card issuers like Chase to increase credit card rewards (i.e. share more of the profit stream with consumers) to ward off competition.

-Second, countries with capital controls want to keep those capital controls.

The most common consumer and business use case for stablecoins today is holding USD exposure instead of a volatile domestic currency. Those consumers are avoiding capital controls against the law of their home country. Regardless of my sympathies, I expect countries like India and China to fight stablecoin-based capital flight.

Furthermore, the vast majority of stablecoins are US dollar denominated. This poses a major sovereignty threat. To allow USDC or USDT to be your major transacting currency is to give up monetary control in your country. That’s not a future most politicians are likely to embrace.

Let’s bring this back to what this means for Remitly.

In the near and medium term, I expect little disruption.

Stablecoin settlements will eventually displace correspondent banking on the back end once liquidity allows. That should moderately lower costs for Remitly and other money transmitters.

Consumer stablecoin wallets, by contrast, face entrenched resistance from banks and governments. It may be a long slog toward mass adoption.

Even if these wallets reach mass scale, remittance firms should remain essential. Apps like Remitly optimize the user experience, balance fraud prevention with minimizing false rejections, enforce KYC/AML across jurisdictions, and orchestrate an ever changing and disparate international banking ecosystem. Remittance apps should also be able to monetize in new ways in a pure stablecoin world, such as charging on-chain FX spreads.

My best guess is that twenty years from now we arrive at a middle ground: a patchwork of fiat currencies, capital controls, and multiple payment rails. Card issuers will find a way to extract fees from wallet-to-wallet payments. Governments will retain capital controls. And remittance companies will continue to intermediate, earning a margin and delivering trust.

In that world, Remitly’s strategy still wins. Customers will keep sending money through the service that is convenient, trusted, and fairly priced. Stablecoins may reshape the pipes, and even the wallets. But those are the qualities that will crown the long-term winner.

4. Trump’s policies favor the cash to digital remittance transition

The second bear case is that US immigration regulation will penalize remittance apps like Remitly.

Here’s how that thinking goes. US outbound sends make up ~2/3 of Remitly’s revenue. If fewer immigrants come to the United States, fewer remittances will be sent back home. Likewise, if the government cracks down on money transfers, digital apps will see less send volume.

In practice, Remitly is taking so much market share from physical cash players that an immigration slowdown is unlikely to make a dent. Before Q2 ’25, a few bears pointed to US-Mexico remittance volumes being down -11.1% YoY and argued that Remitly’s growth would take a hit. Instead, Remitly reported that their US-Mexico volumes grew >35% YoY. Even if US immigration does slow over time, Remitly could probably double their US business before that becomes a noticeable headwind.

So the regulatory bear case comes down to compliance penalties on the remittance industry.

The legacy remittance industry has a poor track record with failing KYC/AML compliance. Western Union has paid hundreds of millions of dollars for failing to monitor cartel transfers in border states or ongoing fraudulent schemes. Bad actors have long sought out the weakest links in the cash agent network to send illicit transfers.

Digital remittance networks are built differently. Most transactions start with debit cards, which means that senders have already passed their banks’ compliance checks. Then the digital remittance apps run their own KYC/AML processes on top. The same software runs the same process for every sender, so there should be no weak agent link to exploit. No system is perfect, but digital remittances are much easier to safeguard.

This year’s legislative debate illustrates this point.

In May, early drafts of the One Big Beautiful Bill included a 5% tax on all remittances. (Kudos to smart short sellers who realized this risk early on.)

The final version of the One Big Beautiful Bill included a 1% tax only on cash outbound remittances starting in 2026. The extra cost should push the marginal customer toward apps like Remitly. For digital players, this legislative risk will become a tailwind.

Legislators likely chose to favor digital remittances because of the clean paper trail created by every transfer. I recommend that you take twenty minutes to transfer $100 through apps like Remitly and Wise to see for yourself. For regulators trying to stop fraud and money laundering, better monitoring is a big advantage.

So yes, I do expect the Trump administration to continue to create headline risk around immigration. However, to the extent this results in more policies that benefit digital remittances at the expense of cash, that’s good news for Remitly.

5. Remitly is trading at <8x '27e free cash flow with 34% YTD revenue growth

This is not a complicated case.

Remitly is growing more than 30% annually, stacking new cohorts of loyal customers, and steadily moving toward 25+% free cash flow margins.

Yet today’s valuation implies an immediate existential threat.

Stablecoins and regulatory shifts are risks worth monitoring, but neither appears fatal. Stablecoins remain a settlement story without consumer traction, especially in developed countries. Card issuing banks are already fighting wallet adoption. So we should expect consumer stablecoin wallet adoption to play out over multiple decades, not a few years. And while immigration regulation may generate headlines, policymakers have already signaled a preference for digital flows with clean audit trails over opaque cash transfers.

Meanwhile, the fundamentals keep compounding. Remitly’s marketing discipline, consistent cohort behavior, and product improvements are building a franchise that grows stronger with scale.

At $19/sh, Remitly is trading at less than 8x ‘27e unlevered free cash flow. By 2032, cumulative free cash flow generation could buy back the entire enterprise value. Long before then, the company’s steady march toward 25+% free cash flow margins should drive a market rerating.

If you think a dominant high-growth consumer franchise growing at least 20% annually can achieve a 20x-25x free cash flow multiple, today’s stock price is quite an opportunity.

The pipes and even some of the wallets may change, but the economics of trust, convenience, and retention endure. And that is what you are buying with Remitly.

Disclaimer: this is not financial advice or an offer of any kind. Do your own diligence. Any risk you take is your own, and we do not warrant the accuracy of anything written here. Assume we are invested in any securities mentioned & may make trading decisions without updating this note.

Please feel free to reach out here or @parisanalyst on X.

Great write up.

Pernas Research has a great write-up on Remitly as well if you're ever interested :)