Evolv – Channel Acceleration & Margin Inflection

Doubling down on the channel + inflecting gross & operating margins

Evolv has traded in an information vacuum since going quiet in Q4 ’24. Their business updates point toward progress, but the market won’t believe it until restated financials are released in the next 8 weeks.

In short, I think the setup works.

A bit delayed from November because the new CEO hasn’t spoken yet to the Street, but that will change once financials go current.

Post-restatement and on a fully diluted basis, Evolv trades at ‘26e <3x EV/sales and ~18x EV/EBITDA. For a high gross retention company growing ARR >30% in 2025 and >25% in 2026, this valuation is disconnected from fundamentals.

The valuation gap should close as the company releases their financials, confirms FCF breakeven, and moderately improves gross bookings.

Evolv deserves a significant premium if bookings growth steps up meaningfully in 2025. The new CEO and CRO are laying the groundwork, and this is the key trend to watch this year.

Evolv is set to accelerate with improving margins through three key initiatives:

1. Driving Express new unit bookings through the channel, launching used unit subscriptions, and cross-selling Expedite. (green)

2. Dropping the negative gross margin Purchase model and leveraging the Express v2 cost reduction to lift gross margin to 65%-70%. (pink)

3. Reducing operating expenses to hit FCF breakeven in ’25, then growing opex at a slower rate than ARR. (yellow)

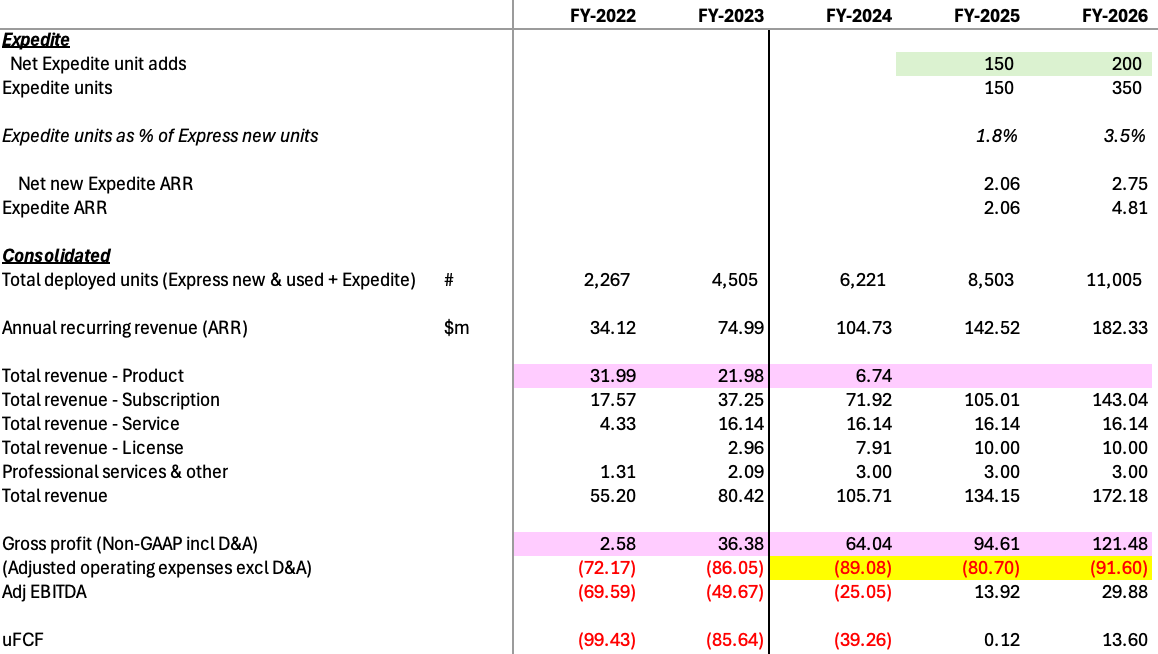

The model below assumes a moderate bookings improvement scenario. These numbers are pre-restatement; this model & post-restatement estimates are my best understanding until we see current financials.

(Extra disclaimer for this one: key insights sourced from channel partners and customers, unit economics confirmed by former mgmt, company confirmation to come post quiet period.)

I’ll start with gross and operating margins, then move on to bookings.

First, dropping the negative gross margin Purchase model and reducing Express v2 unit COGS will drive consolidated gross margin to 65%-70% (pink).

Evolv books through three sales models:

-In the old Purchase model for a four year $80k contract for a v1 unit, Evolv booked $35k in Product COGS in year 1. The four year unit economics were solid, but year 1 gross margin was negative. Evolv discontinued this model.

-In the new Distribution model, the distributor (“CT”) sells the same unit for $80k. CT covers the cost of production, CT takes a $10k cut above cost, CT pays Evolv a onetime $10k hardware fee, and the customer pays an annual subscription fee for software & services. Evolv removes unit COGS from its income statement; CT’s financials absorbs the COGS instead.

-In the hardware lease Subscription model, unit cost is recorded as year 1 capex, and the customer pays a blended hardware + software & services subscription for four years. That capex is depreciated over four years until contract renewal. The depreciable unit life is seven years, though they likely last longer. (More on renewals later.)

Replacing the Purchase model with the Distribution model significantly lifts Evolv’s gross margin and is more capital efficient.

Lower product cost further improves gross margin: Express v1 unit COGS was ~$35k, and Express v2 unit COGS is only ~$22k. I think Evolv only started benefiting from the Express v2 unit COGS in Q3 ‘24 or Q4 ‘24.

If Evolv retains all of the COGS savings, I think gross margin lands at ~70%. If Evolv spreads a few points to channel partners, we land in the mid-to-high 60s.

Either way, a major gross margin uplift.

Second, operating expenses will improve due to the January ’25 RIF and rising depreciation addbacks from Subscription units (yellow).

The January ’25 RIF cut 14% of headcount, but Evolv’s job listings suggest the company is reallocating some savings to new hires:

-Let go: duplicative channel support functions, some BD, and much of the software integration and cloud team.

-Hiring: new quota-bearing roles for the first time since December 2023 (a *great* sign) and new sensors engineering roles.

Reading the tea leaves and confirming with private industry sources, here’s my read:

-Evolv is prioritizing Express and Expedite, while discontinuing Eva compliance software and Extend gun detection. The latter 2 products weren’t as differentiated and made up, best estimate, <0.5% of ARR.

-Evolv is cutting duplicative actions where salespeople were competing with the channel on the same deals. Per one partner, Evolv will still generate qualified leads, while the channel will close and service those deals. The new CEO and CRO are from Motorola Solutions, the largest physical security channel player in North America. This channel approach plays directly to their operating experience.

-Opex savings are being reallocated to new demand-generating and hardware R&D roles.

-Expanding the channel program + more demand generation = significantly increasing Evolv’s sales capacity.

This opex shift lifts Adjusted EBITDA margins markedly: ’23 -62%, ’24 -24%, ’25e 10%, ’26e 17%. Again this model is pre-restatement, so post-restatement we may land closer to ‘25e 6% and ‘26e 13%.

It may seem aggressive to flip from -62% to +17% EBITDA margins in three years, but it’s worth remembering that Evolv’s go-forward gross margin should be 65%-70% and gross retention should be >95%. Axon just printed a 25% Adjusted EBITDA margin on a 63% gross margin and 30% ARR growth (an aspirational industry comp, to be sure).

FCF margin should trail EBITDA by ~10%, assuming Evolv’s gross bookings are about 50/50 Subscription model / Distribution model. They already guided Q4 ‘25 FCF breakeven, so there may be a working capital boost I’m not giving them credit for.

Basically, FCF breakeven should be a solved problem for this company. Today’s valuation does not price this in.

Third, bookings acceleration will be driven by Expedite, used v1 Express units, and new v2 Express units (green).

Expedite.

Let’s frame why customers would buy Expedite, an automated high speed X-ray bag scanner.

Metal detectors have 40+% secondary screening rates for any meaningful metal sensitivity. Think of how often you have to take off your belt / shoes / watch / jewelry / phone when walking through one in an airport. “Secondary screening” means getting wanded down manually by a security guard after the detector (seems to happen to me every time).

Ceia’s Opengate, Evolv Express’s #1 competitor, has a 20+% secondary screening rate at standard settings — according to my customer checks. This rate makes sense because Opengate is an active continuous wave metal detector. Evolv Express aims to do better by using multi-frequency fields to measure an object’s magnetic polarizability. Basically, Opengate aims to see the amount of the metal; Express aims to see the amount, shape, and location of the metal.

Metro Nashville Public Schools reported only 7% secondary screening rates with an Evolv Express in an early implementation phase.

Those secondary screens were all false positives (no guns) – and that’s where Expedite comes in.

You can reduce ~90% of those false positives (mostly laptops) by using Express alongside the Expedite X-ray bag scanner. The X-ray can also catch non-metallic threats. Salem-Keizer reported only a 1% secondary screening rate with an Express + an Expedite.

Legacy X-ray bag scanners are slow and constrained by a guard manually flagging threats on a computer screen.

Evolv’s Expedite X-ray operates at walking speed, automatically identifying threats. No guard sitting behind a computer. No customer lines waiting for bags to pass through. Automated screening is a breakthrough because human X-ray screeners’ performance starts to suffer after only 10 minutes, degrading exponentially over time. A few hours into an eight hour shift, even the most conscientious guard would start to miss things. You still need one person to check Expedite’s bag alerts, but it’s much, much faster.

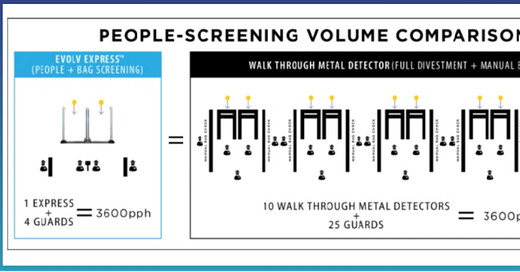

Cruiseport Destinations estimates that 1 dual-lane Evolv Express + 2 Expedites can replace 10 metal detectors and reduce the need for 21 security guards in a bag-heavy environment.

Choosing Evolv equates to roughly $500k in year 1 savings, in addition to a better customer experience:

(Cruiseport sells Evolv units to cruise lines, so expect some bias – but also keep in mind that these opex savings accrue annually to operators.)

Expedite is supply-constrained due to high demand, according to a channel partner.

I’m modeling Expedite cross-sells to reach ~2% of Express units in 2025 and ~5% in 2027.

I think Expedite may outperform those estimates because Expedite can sell to customers who have never used a bag X-ray, but I’m waiting to see early demand trends before modeling more unit sales.

Used Express units.

After speaking with international channel partners who rent Evolv units, I think Evolv is launching a new pricing plan for used units.

Evolv previously faced two business model issues that they’ve now resolved:

-There used to be a concern about Evolv’s Express v1 subscriptions on renewal. The v1 units depreciate over 7-8 years, but a customer renewing today in year 4 would probably want a v2 unit if the price is the same as a v1 unit. Forcing a customer to renew on a v1 unit would be an awkward conversation.

-Some customers are price sensitive, and Evolv would like to win them. But across-the-board price cuts on v2 units would likely result in net revenue loss. (This latter scenario is my understanding of previous management’s plan.)

The big shift is that we are seeing Express v1 Subscription customers renew with v2 units after only 4 years. I think these customers are paying about the same price for the new v2 units as the old v1 ones. But Evolv won’t let these v1 units sit idle.

The existing Express v1 units may soon become available as used units. This makes sense because the real profit is in the annual subscription, not the hardware sale.

Used units should become a second monetization wave and increase contract renewal rates.

If you look at an example Subscription model contract, Evolv sells hardware near cost and then sells the annual software subscription for $11k/lane/yr. This 3/2023 Dekalb quote is discounted ~15% from other quotes I’ve heard.

At the discounted $11k ARR subscription per used v1 unit, the unit economics would be as follows:

This approach solves a number of issues:

-Customers often choose the Subscription model instead of purchasing through the Distribution model because they are willing to pay a bit more for the newest version of the tech. Those customers will renew onto new v2 units.

-Evolv will now have a lower priced used v1 unit to compete against Opengate without imperiling v2 pricing. This is a tried and true path for hardware products, see e.g. Apple’s certified refurbished program or Garrett’s certified open box sales.

-$11k ARR means that the used v1 unit funds the capex for the new v2 unit in ~2 years. It’s possible Evolv will structure the deal so that the used v1 sales funds all the v2 capex immediately.

-Some % of Subscription customers would have churned and will now renew by staying on the v1 unit at the lower price point.

As for negatives, it’s worth addressing potential downsell at the customer level:

-Some % of retained customers will renew at the lower v1 used price instead of the v2 new price. If that customer doesn’t expand, that will be customer-level downsell in year 5 (in the above model, ~$20k hardware+software ARR to ~$11k software ARR).

-To give you the magnitude, I think Evolv would face ~3% ARR downsell if every Subscription customer renewed on v1 and didn’t move to v2.

-If half of the Subscription customers move to v2 while half remain on v1, and the extra v1 units are leased (e.g. as existing customer expansions), the ARR impact would be 0%.

-In reality, we already see Subscription customers moving from v1 to v2, so it’s probably safe to pencil in ~1% ARR headwind on renewals – which is likely offset by customers renewing that would have churned.

I only model a few hundred used unit adds in 2025 and 2026 because I would like to see how they implement this model – but I suspect these used v1 units may lease very quickly to price sensitive customers.

Modeling note here: it’s only the former v1 Subscription model units that this used unit program applies to. Purchase and Distribution units are wholly owned by customers, and associated software & services ARR should just stay in the ARR stack.

New Express units & Q1 ’25 bookings tracker update.

The last major bookings question is gross new Express units.

(I’m referring to new contracts here, separate from the Express v2 units sold to renewing Subscription customers above.)

Our estimated bookings tracker shows Q1 ’25 QTD bookings are ~15% higher than Q1’24 total. At this pace, Q1 ’25 bookings would be up 20% YoY. We need restated financials to calibrate tracking, so I’m reading this as “bookings motion looks as good / moderately better vs. last year.”

To recap recent history, I think Q4 ’23 was a trough marred by salesforce churn and the FTC case, bookings improved sequentially through 2024, and Q4 ’24 was the changeover to new management. It’s hard to think the company won’t execute better in 2025 vs. 2024.

New CEO John Kedzierski and CRO Robert Marshall previously held senior sales roles at Motorola Solutions, the top security channel player. John and Robert are already building up Evolv’s channel motion with new distributors. Recent examples:

-Detectnology became the exclusive Evolv rental provider in the UK.

-Cruiseport Destinations became the cruise industry’s exclusive authorized provider for Evolv.

Evolv is also hiring new quota-carrying sales reps for the first time in over a year (according to 3p alt data): an Education Manager for US west coast school sales and a Sports & Entertainment Partnership Manager for US and European stadiums and arenas. Winning European stadiums would be a major market expansion because Evolv uses stadiums as references to convert non-sports clients.

I am modeling gross new Express units +14% from ~1,750 in ’24 to 2,000 in ’25 and ’26. Even this moderate bookings improvement would grow ARR to 36% in ’25 and 28% in ’26 (numbers pre-restatement).

Channel expansion could drive ARR growth well above 40%, but I’m waiting for management comments before modeling more aggressively.

I still think Evolv has the potential to deploy >3,000 units/yr at full capacity, but at today’s valuation all we need is flat to moderately improving bookings for the stock to work.

In Sum

In 2025, Evolv should be a top-decile public market ARR grower @ FCF breakeven. The company should also exit 2025 at Rule of 40 (~30% ARR growth, ~10% adj EBITDA margin).

‘26e <3 sales and <20x EBITDA looks like a deep discount for this company, especially once financials are current and investor communication is reinstated.

And any signs of bookings acceleration would make the case even stronger.

Risks & Follow Ups

Near-term catalyst path & what went wrong from prior post?

The miss from my November model was thinking that the company would have released restated financials and been reporting openly by now. Besides that, much of the original logic holds:

FTC settlement churn should be cleared by mid April. As of the January 23 update, 0 impacted customers rescinded their Evolv units. I’m modeling 25 FTC-related unit churns to be conservative. I expect closing the FTC case will have moderate price impact. Likewise with the related SEC case.

Financials should go current by early May. Many investors and passive funds are restricted from owning companies that are not current on 10-Qs and 10-Ks, so I expect this to have a meaningful price impact, say to $4.50/sh.

Hitting EBITDA breakeven and guiding continued bookings growth could take this to >$5/sh as smallcap growth investors regain comfort with the model. The big variable is how the new CEO talks about confidence in the bookings motion.

And I still think $7/sh is the number if the company hits full sales attainment and guides a path to a 20% FCF margin model.

How can Evolv drive FCF margin?

Logically, a company with 65+% gross margin, 4-year contracts, >95% gross retention, and minimal ongoing service costs should be able to hit a 20% FCF margin.

Adjusted EBITDA margin is straightforward.

The key unknown FCF variable is the future sales mix between the Subscription model (which hits capex) and the Distribution model (which does not). To hit a 20% FCF margin, I think they need new bookings to be ~80% Distribution model. If they decide to go 50/50 Subscription/Distribution, that FCF margin might drop to mid teens.

Evolv could also improve their FCF margin by financing their contracts. They are facing some of the best credits in the world (Disney, NFL teams, etc.) in four year contracts. Disney’s unsecured credit is (obviously) cheaper than Evolv’s, so Evolv should be able to finance these contracts to offset the capex hit. Unclear if they need more scale to do this optimization or if it’s possible today.

Thoughts on rising competition and how might Evolv compete more effectively?

Ceia’s Opengate is the only noteworthy competitor. Compared to the Evolv Express, it is cheaper, more portable, and has a battery option instead of requiring a power source.

However, Opengate performs worse in weather conditions, is less stable, and has a worse false positive rate than Express – according to my customer checks. Opengate also can’t identify a potential threat location on a person, which means secondary screens take longer and are more dangerous for security guards (they don’t know where the potential weapons are).

The market is wide open: stadiums are switching from legacy metal detectors, schools and hospitals are just adopting, and offices and warehouses are greenfield. I expect demand to grow after seeing legislation introduced for national concealed carry across state lines and for concealed carry on college campuses. Martyn’s Law is also driving demand in the UK.

I see this market splitting between budget/portable-use customers on Opengate and performance-conscious customers on Evolv. It’s an open question who wins this middle and how many downmarket customers Evolv can win with used v1 units. Ceia has shown no interest so far in launching a premium weapons detector or an automated X-ray bag scanner. I think they are quite happy sweeping the low end of the market with a simple and effective product. That should leave a huge opportunity set for Evolv.

Here's where I think Evolv’s pitch can improve:

-More pilots. Evolv has a spectacular win rate among customers who trial, and I don’t understand why every top 100 prospect hasn’t already been sent a free unit to try for 6 months.

-Cleaner data comparisons. John has already changed the marketing pitch to “higher detection with lower false alarms,” and it would really help customers to see differentiation in hard data points. Running these tests in inclimate weather and standard crowd environments would also help.

-Rate of detection improvement. Evolv’s detection algorithm improves over time because it gets better at identifying an object’s shape (not just amount of metal). Opengate can only adjust metal sensitivity. Giving customers a sense of Evolv’s improvement rate should attract premium customers.

-Pilot test standards. I’ve seen some customer pilot comparisons that only test for true positives (e.g. “did both machines catch a few dummy guns in 4 4-hour windows?”). Customers should be testing performance in weather conditions and during typical disturbances in the space. They should be running many sizes of guns / the makeup of those guns / how the secondary screening process works with and without Evolv’s “red box” threat location. Final cost comparisons should include extra security guard salaries for devices with higher secondary screening rates. Setting the right standard for testing should ensure that customers choose the premium product when it fits their needs.

Thoughts on the new board member?

A former Millennium PM and family office CIO joined the board in February after shareholder engagement. No connection or personal contact with him.

It’s a strong positive to have someone with significant public markets experience on the board (to make sure the board chooses a strong public markets CFO & to make sure they don’t push the company to do a dilutive equity raise / anything that would break investor confidence).

Biggest risk to the thesis?

Sales execution.

Everything else looks solid. The market is wide open, demand is growing, and the product is best in class. The FTC marketing headwind should be behind them. FCF breakeven is a lock because they stopped using the negative gross margin Purchase model. The new management team looks very promising.

I think the question you have to ask yourself on sales execution is this: Evolv deployed ~1,750 gross new Express units in 2024 in the midst of an FTC investigation, losing a ton of sales capacity, and top management turnover. With a CEO and CRO from the top physical security channel player and with all other issues behind them, is it reasonable to think they can do at least moderately better in 2025 and 2026?

If you think yes, then you probably think this works.

Is Evolv being set up for an acquisition by Motorola Solutions?

While I don’t think this should be your base case, consider the following:

-Motorola invested in Evolv’s PIPE and reportedly made a bid before the DeSPAC.

-Motorola’s head of M&A is on Evolv’s board.

-The new CEO and CRO were in senior management at Motorola.

-Motorola is a serial acquirer in the space (I count ~30 acquisitions in the last decade).

-Motorola needs a weapons detector in their portfolio.

-Evolv’s new channel approach aligns with how Motorola operates.

-Evolv is discontinuing noncore products (Eva & Gun Detect) and progressing toward FCF breakeven, which should make the company easier to acquire.

So the fact pattern fits.

Definitely a possibility, but we should underwrite bookings performance first and foremost. Any future acquisition is a potential bonus.

Disclaimer: this is not financial advice or an offer of any kind. Do your own diligence. Any risk you take is your own, and we do not warrant the accuracy of anything written here. Assume we are invested in any securities mentioned & may make trading decisions without updating this note.

Please feel free to reach out here or on X @parisanalyst.

Excellent work. Thank you for sharing. We have been researching and investing in Evolv for some time now. You clearly have done your homework and really understand the company, perhaps better than the company does ;-). I am a little curious as to why expedite might be supply constrained. Unless they have a different manufacturing partner for that it should not be the case. Something to probe more. I think expedite growth *could* be a positive surprise.

Excellent report! We are more bullish after reading this 🐂